Sales tax is a single-stage tax imposed on taxable goods manufactured locally by a registered manufacturer and on taxable goods imported by any person. Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5.

Guidelines Of 100 Exemption Of Excise Duty On Vehicle For Orang Kurang Upaya OKU Type Inability Physical Defects Dumb Hearing Defects Budget 2007.

. Sales tax in Malaysia is a single-stage tax imposed at the. Exemption on sales tax for cars extended to June 30 2022. The following person are exempted from Sales Tax.

The sales tax exemption can be categorised into two groups such as exemption by order of the minister and specific exemption. The Service tax is also a single-stage tax with a rate of 6. This exemption will be effective from Jan 12021 to June 302021 it said.

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. GETTING READY FOR SALES TAX EXEMPTION APPLICATION. According to Bernama currently the sales tax for vehicles is set at 10 for both locally assembled and imported.

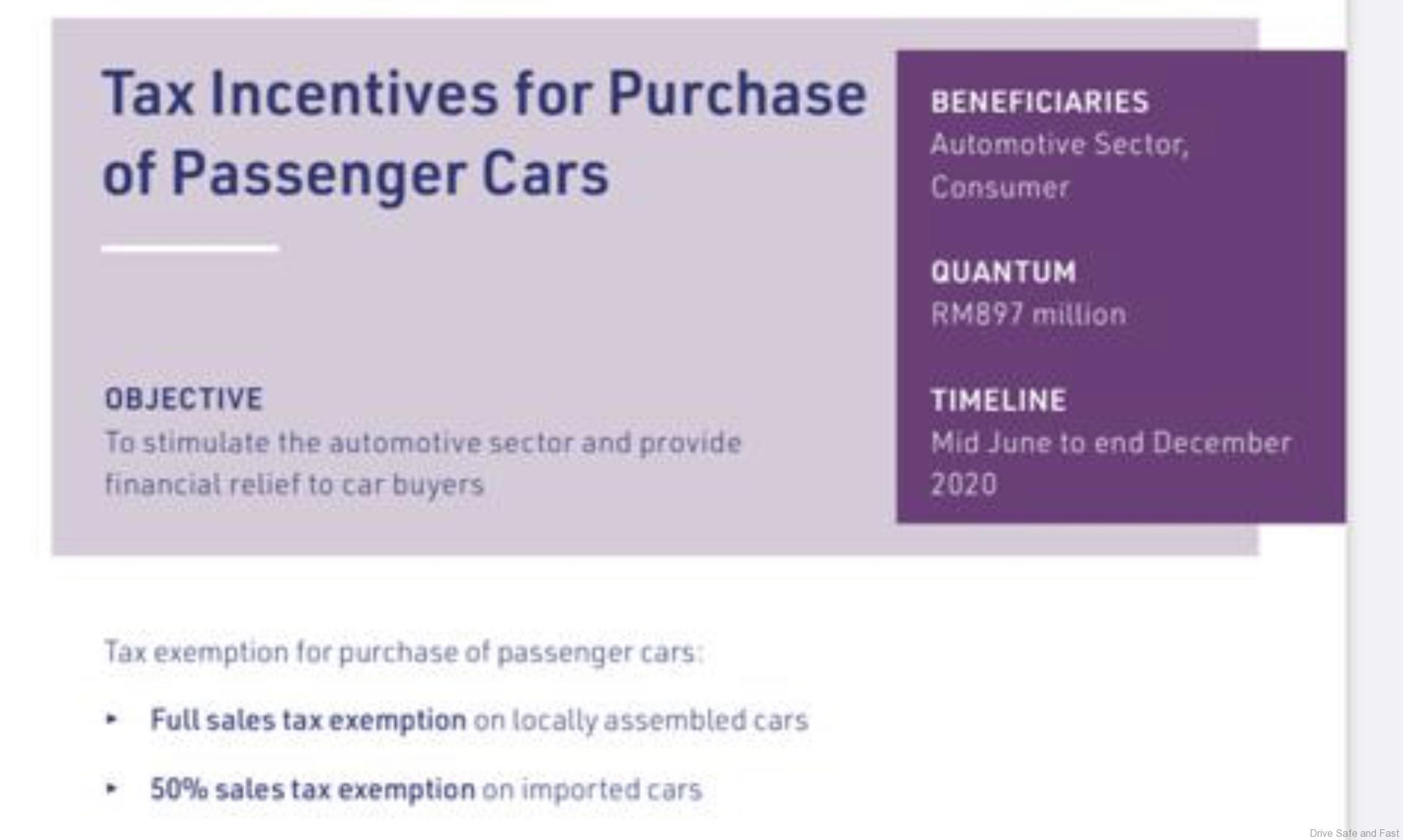

26th May 2022. Substituted HS Code 04039090 60 with 04039090 90. As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent.

The Sales Tax Persons Exempted from Payment of Tax Amendment No2 Order 2020 was published in the official gazette on 5 October 2020 and is effective 6 October 2020. The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence. Jalan Rakyat Kuala Lumpur Sentral PO.

Effective 6 August 2021 amendments pertain to the following among other measures. Best viewed in Google. The sales tax exemption currently in place for Malaysian.

Included HS Code 22029910 00. Under the Sales Tax Act 2018 sales tax is charged and levied on imported and. For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model.

Facilities Under The Sales Tax Act 1972. It is extended for another six months from 1 January to 30 June 2022 for new CKD and CBU cars. Car buyers will be able to enjoy an exemption on sales tax for a while longer as the government extends the.

Application for Import Duty Exemption on Raw Materials Component. Tax Incentive Scheme For Operational Headquarters OHQ Guidelines to Apply Discount On Contribution to Community Projects and Charity. Such approved traders and manufacturers are granted full sales tax exemption on their importation or purchase of goods.

Ruler of States Federal of State Government Department Local Authority Inland Clearance Depot Duty Free Shop. Sales Tax exemption under Item 1 or Item 3 Schedule C of the Exemption Order. 2022 Mercedes-Benz A200 A250 Sedan Msian review.

3 For pallets which are used to transport goods exported and subsequently reimported the. Sales Tax Exemption Certificate Malaysia. According to the Sales Tax Act 2018 Section 35 the Minister has the authority to exempt sales tax.

Sales tax exemption expansion. Application for Import Duty andor Sales Tax Exemption on Machinery Equipment. As with most other exemptions buyers applying for the resale exemption must provide their sellers with written.

The government has announced that the current sales tax SST exemption for new vehicles has again been extended through to June 30 2022. CONTENTS Scope and Charge Rate of Tax Taxable Goods Goods Exempted From Tax How Sales Tax Works Manufacturing Taxable Person Registration Responsibilities of A Manufacturer Exemption and Facilities Record Keeping Taxable Period Return Payment and Penalty Refund Remission Drawback Contents updated until 30102018. In the service tax no input exemption mechanism is.

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia. The sales tax exemptionreduction is applicable from. Item 1 Schedule C.

Exempt goods and goods taxable at 5 are defined. Malaysia sales tax exemption not for motorcycles. Based on Malaysias Sales Tax Exemption Guidelines there are three types of exemption allowed in the Purchase section.

Malaysia Sales Service Tax SST. In addition to the specific text each exemption card bears one of the four animal symbols indicating the specific nature of the cardholders tax exemption. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business.

Internal Tax Division Sales Tax Branch Royal Malaysia Customs Head Office Level 4 South Block 2G1B Ministry of Finance Complex Precinct 2 Federal Government Administration Center 62596 Putrajaya Malaysia. Download the respective format. 2022 Toyota Yaris 15G review in Malaysia from RM74k.

Guideline on 50 Excise Duty Exemption For the. Effective from 1 September 2018 Sales Tax Act 2018 and the Service Tax Act 2018 together with its respective subsidiary legislations are introduced to replace the Goods and Service GST Act 2014. From 1 April 2022 Malaysias public health measures were eased and our borders are now open for business.

With the country still recovering economically from previous lockdowns an extension of the car sales and service tax SST exemption on all passenger vehicles has been announced during the 2022 National Budget presentation. Box 10192 50706 Kuala. The Malaysian authorities updated information with regards to the sales tax exemption.

Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used. This tax is not required for imported or exported services. Class of person eg.

The information ccntained herein is ot a general nature and is not intended to address the circumstances ot any particular. Qualification to Obtain the Sales Tax Exemption Facility. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally.

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate Reque Literal Equations Letter Example Resume Template Examples

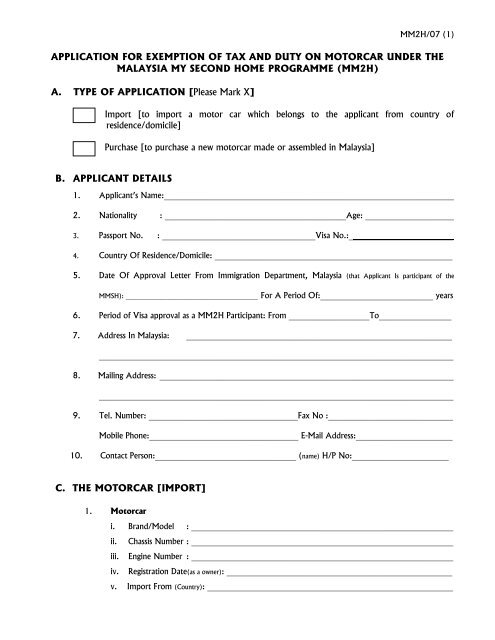

Application Form For Tax Exemption Personal Car Malaysia My

How To Fill Out The Sst And Mtc Exemption Certificate Forms Youtube

How To Fill Out The Sst And Mtc Exemption Certificate Forms Youtube

Businessusetaxexemptform Motion Raceworks

Mini And Bmw Prices With Sales Tax Exemption Topcarnews

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

Tax Exemptions Deductions And Credits Explained Taxact Blog

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Sales Tax Exemption For Ckd 100 And Cbu Cars 50

Pin By Nawaponrath Asavathanachart On Cars Trucks Rear Wheel Drive Isuzu D Max Commercial Vehicle

![]()

10 Sales Tax Exemption Won T Mean 10 Price Drop In Ckd Cars

Requirements For Tax Exemption Tax Exempt Organizations

Mini And Bmw Prices With Sales Tax Exemption Topcarnews